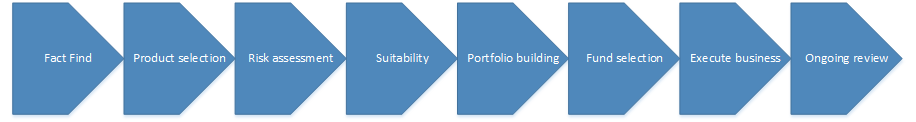

We follow a standardized process to arrive to the best investment solution for the client. This process involves the steps shown in the above diagram.

Fact find. Identify the time horizon, investment needs along the time horizon, attitudes and objectives. These will be used as the criteria for the next steps.

Product selection. While the SelfSelect researched range of funds and the Managed Portfolios are flagship and safer products, there is the option to access a wider investment range known as ‘open architecture’. Open architecture offers clients the freedom to invest in a much wider range of investment assets from numerous markets.

Risk assessment. We assess the risk appetite and the risk capacity of the client. This exercise based on sophisticated questionnaires that will pinpoint the risk tolerance of the client.

Suitability. When assessing suitability, our investment recommendation must take into account not only the client’s attitude to risk/loss, timescales and need for access to capital, but also a range of other factors such as attitude to cost, need for a broad or narrower range of assets, investment knowledge and experience, need for involvement in investment decisions, need for review.

Portfolio building. Having agreed a client’s attitude to risk, we build a tailored portfolio of assets. The mix of assets that you include in the portfolio needs to work together to meet the client’s risk profile and their investment goals. Whilst the individual mix of assets needs to be tailored, all good portfolios have one common thread – they are diversified. Diversification is an important tool in reducing the volatility of the overall investment and helping to achieve long-term investment goals.

Fund selection. Effective portfolio construction involves understanding the client’s investment goals along with their attitude to risk, then choosing the appropriate investments to match. We regularly review the selection to ensure that the portfolio continues to reflect how these needs can be met in changing market conditions. All of this requires access to the right investment solutions, with the flexibility to refine the investment choices as the needs of your client change.

Our portfolio products offer the client the freedom and flexibility of choice by providing access to a wide range of asset types such as:

1. collective funds

2. equities and shares

3. fixed interest securities

4. structured products

5. hedge funds

6. multi-currency deposits

7. exchange traded funds

8. other alternative investments.

Execute business. Open the account and buy the assets.

Ongoing review. We review your client’s portfolio at regular intervals to ensure it still reflects their attitude to risk and that it is performing in line with expectations.

Giving discretion over your investments means that day-to-day decisions on what to buy and sell and when to act are made by your investment manager. They will recommend a portfolio of investments that matches your objectives and they will make adjustments depending on market and economic changes as well as shifts in your timeframe, risk tolerance and objectives.

You will be assigned your own dedicated investment manager who will create your bespoke investment portfolio. This will be designed according to your personal investment objectives and with consideration to your individual attitude and tolerance to risk.

You will also enjoy a truly personal, convenient, local service thanks to our network of 14 locations across Ireland and the UK and with an offshore presence in Jersey and a representative office in Dubai.

Quilter Cheviot is one of the oldest and largest investment management firms in Ireland and the UK. Our investment managers have an average of 19 years’ investment experience. You can be assured of the attention of an experienced investment manager who has a deep understanding of a broad universe of investments and a discretionary arrangement that enables them to take advantage of investment opportunities.

You can speak to your investment manager whenever you want – you will have their direct telephone number and email address. As well as regular meetings, you can see them when you want – we have an open-door policy for clients.

Your investment manager will check regularly with you to see if your requirements or personal circumstances have evolved and make adjustments if necessary.

Using a rigorous research process, we distilled the thousands of available funds into our Global Partners range: a focused range of high quality managers that we believe can deliver superior investment performance for investors.

We continually monitor the performance and behaviour of all managers in the Global Partners range to ensure they continue to deliver to our expectations. With extensive and long-established industry contacts and relationships, we are able to secure regular, direct access to the key people we invest with, to fully understand what they are doing.

In addition, as the majority of funds are run as segregated mandates, we have full access to portfolio information, allowing us to undertake very precise, in-depth portfolio analysis and ensure that managers stick to the agreed objectives and parameters.