The following two issues by Quilter International and BNP Paribas are valid for the current market conditions. However, as the market conditions are volatile, they will be repriced at the time of purchasing. Any gain will be given to the investor. If lower then the investor has the option to opt out.

Any interested investor should speak to our advisers on 25 820 541.

Article about the Global and economic outlook amid the pandemic by our DR George Theocharides April 2020

The two structured products have the following features:

If on a quarterly basis, the closing price of each underlying (S&P500, Euro Stoxx50, FTSE100) is greater or equal to 85% of their initial level, a coupon will be paid plus all previous missed coupons (memory effect). This coupon is at least 1.25% per quarter for the EUR, and at least 1.5% for the USD product. If this does not occur, then no coupon will be paid.

If on a quarterly basis at or after the 4th observation, the closing price of each underlying (S&P500, Euro Stoxx50, FTSE100) is greater or equal to 100% of their initial level, the note is automatically redeemed at 100%. Else, the note is still live.

If at maturity, the closing price of each underlying is greater or equal to 50% of their initial level, the note is automatically redeemed at 100%. Else, a loss in capital will occur and the note will be redeemed at 100% plus the negative performance of the worst underlying.

| Property | 5Y EUR Phoenix Memory with 1 year no autocall | 5Y USD Phoenix Memory with 1 year no autocall | |

|---|---|---|---|

| Structure | Memory Phoenix | Memory Phoenix | |

| Maturity | 5 years | 5 Years | |

| Basket | Worst of (S&P500, Euro Stoxx50, FTSE100 | Worst of (S&P500, Euro Stoxx50, FTSE100 | |

| Currency | EUR | USD | |

| Autocall trigger | 100% | 100% | |

| Observation | Quarterly | Quarterly | |

| No autocall | 1 year (autocallable at or after the 4th observation) | 1 year (autocallable at or after the 4th observation) | |

| Memory coupon | min 1.25% (5% p.a) | min 1.5% (6% p.a) | |

| Coupon barrier | 85% | 85% | |

| Capital barrier | 50% at maturity | 50% at maturity | |

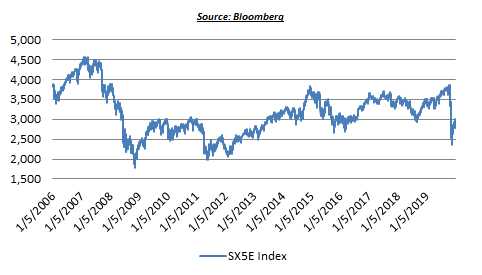

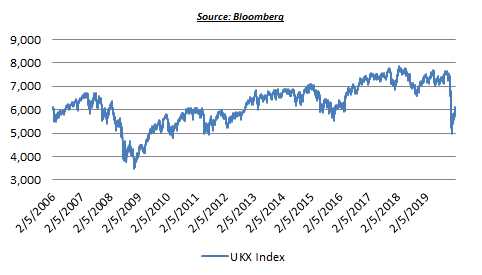

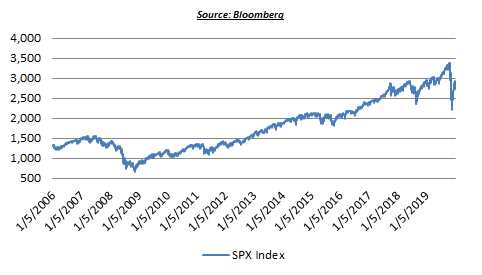

The following graphs and table show the maximum drawdowns for the three indices during the COVID 19 pandemic and the 2008 crisis. The article staying calm in a crisis shows additional drawdowns during other pandemics.

| Max Drawdown | UKX Index | SPX Index | SX5E Index |

|---|---|---|---|

| Covid 19 | -34% | -34% | -38% |

| 2008 crisis | -47% | -56% | -59% |

Term sheet for Phoenix Memory EUR

Term sheet for Phoenix Memory USD

Weekly commentary podcast from our asset management company Quilter Cheviot

Managing investments during a crisis by Quilter Financial Planning

Staying calm in a crisis - article by Danny Knight of Quilter Investors

Quilter's Market Explainer - weekly webinar

Weekly commentary: between the lines by Quilter International

The value of investments and the income from them can decline, you may not get back what you invest.